What are Stablecoins?

Beginner

The past few years have marked an increase in the adoption of various cryptocurrencies like bitcoin, ethereum, litecoin, ripple, and many others. However, despite the increased acceptance of cryptocurrencies, high volatility which makes prices fluctuate has presented a challenge that has not made cryptos suitable as mediums of exchange.

Basically, investors and traders prefer less volatility in these currencies for everyday transactions. When trading too, less volatility means you can make profit and not lose everything with just a single dip. And when this happens, the adoption of cryptocurrencies can increase even more because of the stability that will come with it.

This, among other reasons, led to the creation of stablecoins.

What is a stablecoin?

In case you were wondering, stablecoins don’t just have the features of hypothetical fiat money. Rather, they are backed by actual reserves of a fiat currency or any other asset. This means that stablecoins are tied to external assets so that every stablecoin is a token of a physical asset.

A stablecoin is a type of cryptocurrency that characteristically has a stable price. Stablecoins take the properties of external assets while existing on the blockchain and sharing the properties of cryptocurrencies.

Types of Stablecoins

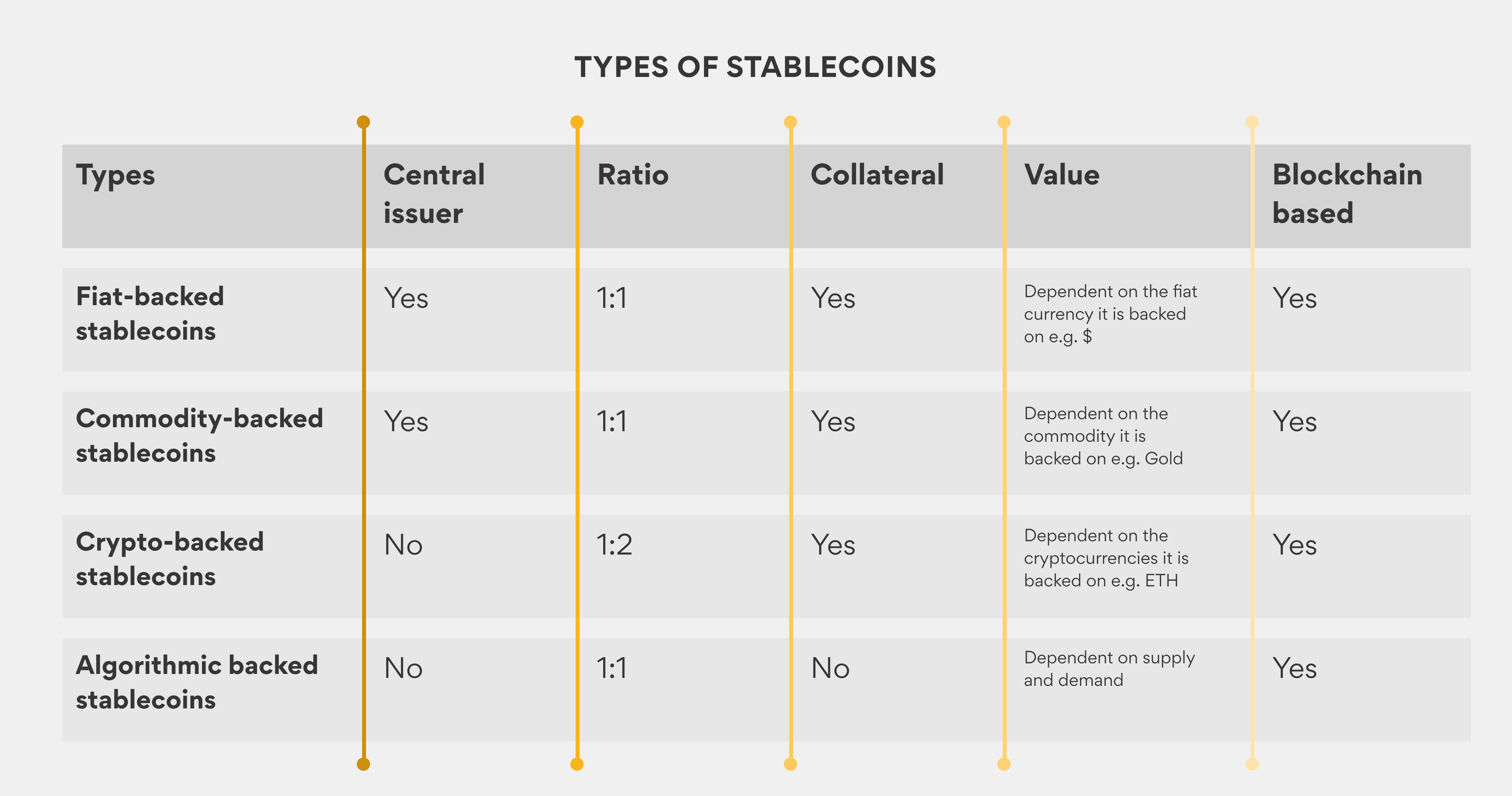

There are different types of stablecoins, with each working in a specific pattern or system. These types include:

As the name suggests, these types of stablecoins are backed by fiat currencies, usually in a 1-1 ratio. For a fiat-backed coin to operate, it needs a central issuer (financial custodian) such as a bank. The central issuer holds a certain amount of fiat money and then issues out an equivalent amount of tokens so that one can easily complete daily transactions using these tokens and also redeem them at an equivalent price.

However, there is a need for regular auditing of fiat-backed currency to ensure that they remain collateralised. Examples of fiat-backed stablecoins include USD Coin (USDC), Tether (USDT), and Paxos Standard (PAX).

Crypto-backed stablecoins

Crypto-backed stablecoins are similar to fiat-backed stablecoins; the only difference is that they are pegged to another cryptocurrency. For instance, a cryptocurrency like Ethereum could be locked up as collateral to enable a crypto-backed stablecoin. However, unlike fiat-backed coins, there is no one central issuer. The entire network of users of that cryptocurrency represents the financial custodian, thus promoting the decentralised nature of the stablecoin.

In order to implement a crypto-based stablecoin, users would have to lock their cryptocurrency in a contract, after which the tokens are then issued. For the collateral to be returned, the stablecoins need to be paid back into the setup contract. Dai and BitUSD are examples of crypto-backed stablecoins.

Algorithmic (non- collateralised) stablecoins

The system used by centralised banks in managing fiat currency is similar to the one used to operate an algorithmic stablecoin. Rather than peg these stablecoins to currencies or commodities, they are run with algorithms and smart contracts that manage tokens.

Smart contracts are enabled on a decentralised network and run autonomously. That is, the increase or decrease in the supply of tokens in circulations is determined by an algorithm. The smart contract allows this action based on the price of the stablecoin in relation to the price of a particular fiat currency it tracks. So, if the price of the cryptocurrency falls above the fiat currency value, then the token supply would be automatically improved and vice versa.

Although algorithmic stablecoins are not considered collateralised stablecoins, they may hold collateral. This is to safeguard these currencies in a situation of an event that may affect the volatility of the stablecoin. An example of an algorithmic stable coin is the Basis and Carbon.

Commodity-backed stablecoins

Commodity-backed stablecoins are pegged to interchangeable assets such as gold or other precious metals. These commodities have a relatively stable price and that is why some stablecoins are pegged to them. Using these stablecoins allows individuals to access some investment opportunities that are only limited to the wealthy such as real estate or precious metals.

The benefits of stablecoins

It is clear that there the creation of stablecoins is a huge plus to the crypto community, so let’s run through some of the benefits of using stablecoins:

- Faster transactions: Price stability encourages people to meet their financial transactions with ease so they no longer need to worry about price fluctuation before completing transactions. Organisations with employees across the world can use stablecoins to pay salaries with minimal transaction fees with a guarantee of instant delivery.

- Increased adoption of cryptocurrencies: The availability of stablecoins will encourage more people to trade and invest in cryptocurrencies, especially in places with fiat currencies that are prone to inflation.

- Integrate cryptocurrencies with fiat currencies: Cryptocurrencies and fiat currencies used to distinct markets with just a little intersection. However, fiat-backed stablecoins offer a way to integrate the markets. Cryptocurrencies would no longer be limited to trading and investments. Credit market that had majorly centred on fiat currencies would be able to incorporate stablecoins into payment and receiving of loans.

Common challenges facing stablecoins

Stablecoins offer several potentials, however, there are a few drawbacks:

- Stability of the pegged currency or commodity: A stablecoin’s stability is linked with the stability of the asset that it is linked to. Although not a common issue but if the price of the asset that it is linked to fluctuates, the stablecoin would also be affected.

- Trust in the central issuer: Often, there is the question of trust in a central issuer. That is, does the central issuer have the collateral it claims to have? Tether, for instance, experienced this in its early days. However, transparency from the central issuer would often set this reservation aside.

- Decentralisation: One of the reasons cryptocurrencies are so popular globally is because of their decentralised nature. However, stablecoins often require a central issuer to manage the collateral.

In conclusion...

The increased adoption of cryptocurrencies has led to a desire for a more viable option to manage the high volatility of cryptocurrencies. And stablecoins offer this solution. As the cryptocurrency network broadens across the globe, stablecoins represent a bridge that would ease the adoption and increase digital currencies' stability.

Crypto scoop

Sign up for our weekly newsletter

Stay informed with the latest updates to buy, sell, and store your crypto on the go.

Download the Yellow Card app

Start trading crypto with ease

Get the Yellow Card app to buy, sell, and store your crypto on the go.